The Malaysian Inland Revenue Board issued a set of updated frequently asked questions FAQs on the special tax deduction available for landlords that. Hence it is important for property investors to understand the actual taxation on rental income before they start to.

Blog News Updates Rent Returns Investment Property Investing Infographic

Example 6 Facts are.

. It is also calculated on a net basis where all. When rental income is assessed under section 4 d it. You will only need to pay tax if.

Whats the income tax on residential lettings in Malaysia. To legislate the proposals the following Rules were gazetted on 8 September 2021. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

Azrie owns 2 units of apartment and lets out those units. However those rental income are taxable based on Malaysia Taxation Law. Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA.

Income received from the letting is charged to tax as rental income under paragraph 4d of the ITA. Discover how much a foreign landlord earning rent will actually pay using worked examples. Gross rental income is US1500month.

In Budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices. The tax levied on the average annual income on a rental apartmentproperty in the country. This is after EPF.

The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding. Nonresidents are taxed at a flat rate of 24 on their Malaysian-sourced income. Rental income taxes.

Set under a separate category rental income tax comes with its own progressive tax rates that range between 0 and 30. March 1 2021. The amount of income you earn exceeds RM34000 per Annum and if you break it down to per month around RM283333.

Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967. In order to promote affordable.

Now in 2019 the time has come for property owners. Rental income is taxed at a flat rate of 24. Income tax on rent.

Maintenance services or support services provided by Azran Sdn Bhd. According to Thannees Tax Consulting Services Sdn Bhd managing director SM. The deduction applies to rental of premises for business premises only.

Prior to Jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption.

10 Methods Landlords Can Use To Verify Proof Of Income Rentspree Blog

Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A Landlord Rental Property Management Rental Income

How To Keep Track Of Rental Property Expenses Rental Property Spreadsheet Template Rental Income

Provision For Income Tax Definition Formula Calculation Examples

Calculation Of Income From House Property How To Save Tax On Rental Income In India Rental Income Tax Deductions Standard Deduction

If One Or More Of These Houses Strongly Appeal To You You May Be Wondering How To Go About Looking At And Pur Real Estate Real Estate Leads Real Estate Quotes

Customizable And Printable Rent Receipt Templates To Help You Save Time When Creating Receipts Receipt Template Templates Printable Free Free Receipt Template

P Amp L Statement Template Elegant Free Spreadsheet For Rental Property Expenses And In E Statement Template Templates Dental Abbreviations

Rental Property Tax Deductions A Comprehensive Guide Credible In 2022 Tax Deductions Being A Landlord Property Tax

Genting Highlands Malaysia The Best Place For Property Investment In Malaysia For 2018 Investment Property Investing Property

Gauravshahgs I Will Do Accounting Book Keeping And Tax Consultancy For You For 30 On Fiverr Com Accounting Books Tax Consulting Accounting

How Is Taxable Income Calculated How To Calculate Tax Liability

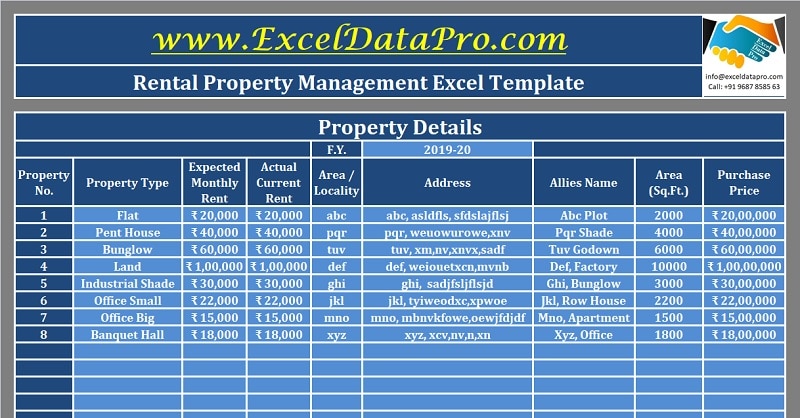

Download Rental Property Management Excel Template Exceldatapro

The Recent 2019 Budget Tabling Has Put Forth Several New Measures Particularly In Property Investment There Is Now A 5 Investing Budgeting Property Investor

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important